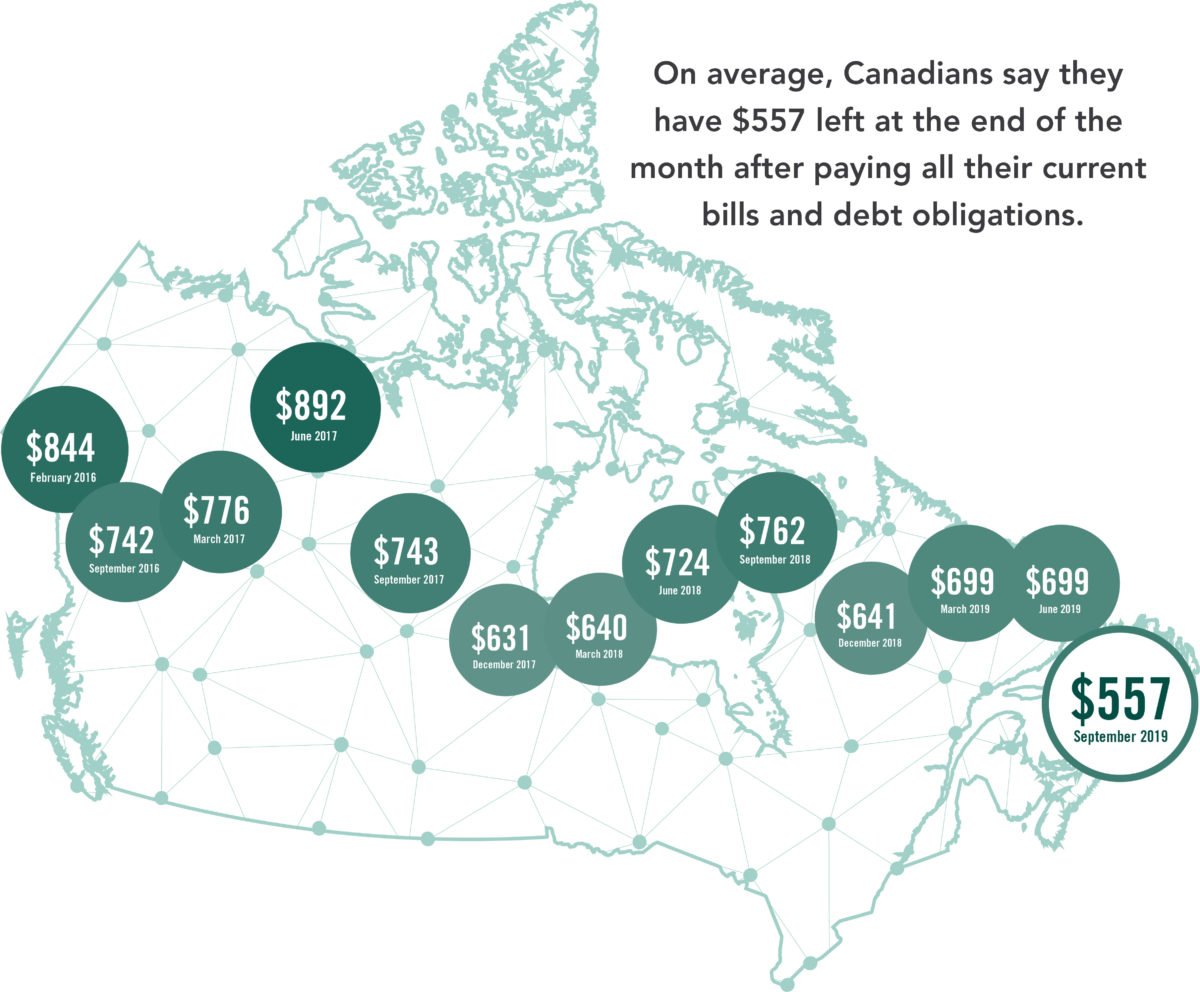

This week I had the opportunity to be interviewed on a local talk radio show, Kitchener Today with Brian Bourke at 570 News. We had a great conversation on a topic that is not always easy to discuss yet definitely important—Canadians’ debt levels. Consumer debt and financial literacy are topics that are very much on the mind of Canadian policy makers, bank and credit union executives and, I imagine, regular Canadians. That’s because research indicates that 47% of Canadians won’t be able to cover basic living expenses without taking on more debt. (MNP Consumer Debt Index – October 2019). And, “more than half (54%) of Canadians say they are more concerned about their ability to repay their debts than they used to be.” The infographics on this page present the survey results pretty clearly.

I don’t think that people should have to take on more debt in order to cover basic living expenses. That said, does it surprise me that many Canadians don’t have a buffer to protect themselves from unexpected life events? Unfortunately no, not really. The last decade’s low interest rate environment combined with a strong equities market, strong employment numbers, and a housing boom (including much higher purchase prices), means that many people are taking on debt to finance their day-to-day life. Add to that a modern consumer mindset of instant gratification that asks ‘how much of a monthly payment can I afford’ instead of ‘how long do I need to save for that’, and you have a recipe for the unprecedented consumer debt levels we’re seeing in Canada today.

While the Bank of Canada held rates steady on October 30, I’m concerned how much deeper the problem might get when interest rates begin to rise. (Notice that I didn’t say “if”.)

I’m so thankful that I lead a credit union, which by definition means we have a member-ownership business model, allowing us to always put members’ interests first. We’re not chasing quarterly earnings and we’re certainly not maximizing profit for distant investors. We want to do right by our members and help them where they are at. We want to get them where they want to go and achieve what’s most important to them.

Many financial commentators will talk about individual Canadians having “too much house” or “too much car” and that, essentially, means that they’re living beyond their means. At Kindred, our team members are not commissioned or incented to sell specific types of financial products or services. We coach our members on responsible use of credit and there are times when “in a member’s best interest” means that we might not grant them a loan because we believe it’s not sustainable in the long-term. At the same time, we’ll work with members to help them achieve their goals. A person’s financial journey is a lifelong pursuit; we’re with our members over the course of that journey, and we want them to be successful.

If you don’t have a financial plan or you’re struggling with debt, take a moment to take the next step. Contact your financial service provider, call Kindred, or stop by one of our branches.

Not sure how to get started? Get in touch with Kindred and ask for me directly; I’ll connect you with a member of our team.

The MNP survey of 2,002 Canadians was compiled by Ipsos from September 4 to September 9. MNP says the results are accurate within 2.5 percentage points, 19 times out of 20.

A person’s financial journey is a lifelong pursuit; we’re with our members over the course of that journey, and we want them to be successful.