The 1980s was certainly a time of change around the world: in the midst of unprecedented economic growth, many countries also experienced multiple debt crises.

It was during this time that the credit union increasingly distinguished itself from traditional financial institutions– from a Statement of Philosophy, to the development of the Member Assistance Service fund (now known as Member Assistance Services), to welcoming our first female Board Chair, Joyce Collard.

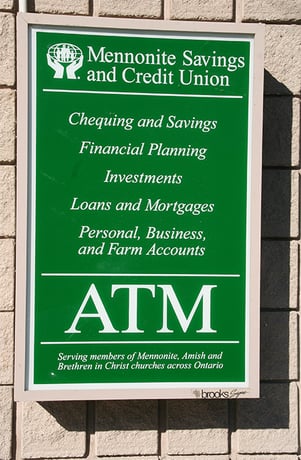

It was also when we transitioned from Mennonite Credit Union to Mennonite Savings and Credit Union (MSCU), and began an entirely new chapter for our credit union.

Mennonite Savings and Credit Union (MSCU)

Mennonite Savings and Credit Union (MSCU)

The Mennonite Credit Union Elmira branch was doing so well serving its members, that it had to move locations in 1980 to a larger, renovated facility on Arthur Street. By this time, Lloyd M. Martin was the Board President, and under his leadership, the credit union’s growth in assets went from $2 million to $20 million – in just four years.

While the credit union opened its charter province-wide, membership was still restricted to those who were members of Anabaptist churches. On March 23, 1982, the Board adopted a more specific Bond of Association in a by-law change where membership opened to Amish and Brethren in Christ (now Be in Christ). Temporary membership began to accommodate those who didn’t yet qualify, such as those moving to Ontario, or who were not yet baptized members of churches.

Membership continued to grow for MCU, and on September 3, 1982, a branch was opened in Milverton ! Nearly a year later, on September 6 1983, an MSCU branch in Waterloo opened at 55 Bridgeport Road East along with a head office. By 1984, MCU had been in the credit union business for twenty years, and celebrated that while reaching 5,000 members!

The start of 1987 saw the first female Board Chair elected: Joyce Collard (nee Zehr) and the credit union’s assets reach $50 million. Not even a year later, assets almost doubled, reaching $93 million in 1988.

It was in 1989, just in time for MSCU’s 25th anniversary, that the next big change happened for the credit union – the name changed from Mennonite Credit Union to Mennonite Savings and Credit Union (MSCU) on May 19, a name many existing members would still recall!

That year also included the opening of the Leamington branch at 243 Erie Street South in May, our Head Office moved to 200 Weber Street in Waterloo, and the first membership shares were offered. While new members now invest $25 when they open a membership, in 1989 members had the option of $25 per year for 10 years, or a one-time payment of $250.

The 1990s ushered in several changes and brought prosperity to the credit union in ways that allowed its team members to truly expand our values and purpose. Assets grew – over $100 million in 1990 and over $129 million by 1992, and furthering the initial vision of mutual aid, “Member Assistance Services”, or MAS, was created in 1994. MAS is a unique program that responded to needs within our communities and promotes sharing and acts of compassion. MAS combines our commitment to mutual aid with the resources of a vibrant credit union to provide our members with the opportunity to both offer and access financial assistance in times of need and in times of plenty.

Our past Annual Reports make this clear, stating: “To make a difference in people’s lives through exemplary service that reflects the voice of the member and the values of our faith community. This is more than a mission statement for MSCU; it is a declaration that guides us in our everyday dealings with our members, our volunteers, and each other. The cumulative impact of all member and community stewardship initiatives include MAS and low-interest economic development loans, the MSCU Charitable Fund, Church Builder, bursaries, and sponsorships.”

The 1990s saw $367,500 invested in Share Deposits – previously called Equity Shares. Ethical Funds – the predecessor of our Socially Responsible Investments – were also available in 1994.

Right from the start, our credit union was thinking about our impact in the wider community. The question of “how can we help?” led to the Mennonite Savings and Credit Union Charitable Fund in 1998! $360,000 was deposited as part of our 36th year.

At this time, MSCU also experienced a change in leadership from Cliff Schott to Nick Driedger. Under Nick’s guidance, the Council of Members was established. The Council of Members is a committee of member volunteers with representation from all MSCU branches. This approach to discerning qualified candidates, first introduced in the fall of 1992, resulted in diverse and competent boards for MSCU who have served the membership well and been excellent guardians of our values.

The mid-90s saw further expansion for the credit union: assets grew to $143 million, the 100th employee was hired, Head Office moved to a new location on Frobisher in Waterloo, and the Waterloo branch moved to 53 Bridgeport Road East. In September 1994, Aylmer began to operate with partial service at 1-300 Talbot Street West in the back of the local Mennonite Community Service thrift store. By 1995, our membership had reached 11,000 members without any sign of stopping.

The second half of the 1990s saw expansion in products and services as well as endowments and fundings. Many of our products reflect our values and roots in mutual aid, economic justice, and service in our day-to-day financial lives. The Church Builder Term Deposits, student credit line, and RESPs were some of the products that MSCU began to offer in the late 1990s. There was also the addition of US Chequing accounts to coincide with the ease of global banking for our members – at home in their local communities and online as well as we launched our first website. You can still see what it looked like on the Wayback Machine!

As Y2K loomed, MSCU finished the millennium with a new mission statement:

“Mennonite Savings and Credit Union (MSCU) draws on its Anabaptist heritage to uniquely shape its vision and direction. The Anabaptist vision is centred on the belief that God works in our lives through the power of the Holy Spirit. This vision focuses on three fundamental beliefs: that discipleship is a way of life patterned after the life and teachings of Jesus; that the church is a community of faith practicing mutual support; and that God calls each of us to a life of love in just and non-violent relationships.

As members of Mennonite, Amish and Brethren in Christ communities, we have joined together and become members of MSCU to help us apply the biblical concepts of stewardship, economic justice and service in our day-to-day economic lives and financial transactions.

MSCU is a contemporary vehicle for continuing and building our commitment to responsible stewardship of all resources and to being responsive to needs within our communities.”

The 2000s wasn’t just a new millennium – it was a new chapter in MSCU’s history. In the early 2000s, assets increased over 13%, totalling $374 million while membership increased to 13,915. There were more branch openings, relocations, and renovations in the early 2000s than the previous forty years: Milverton moved to a new location, the Head Office moved to Kitchener, Elmira moved (again!), Aylmer expanded, and Mount Forest offered partial service.

Just before MSCU’s fortieth anniversary in 2004, our membership reached 16,000, and we had 200 employees by 2005. MSCU’s first Investment Share Offering raised $15 million within the first two months of being available. Our mutual aid products and charitable funds were also providing clear, strong support: the Member Assistance Services (MAS) had 114 loans totalling $1.73 million by 2005; the Church Builder GIC had donated more than $134,000 to 109 churches and organizations, and the MSCU Charitable Fund had grants totalling $37,662 to 17 projects in 2006.

In 2007, MSCU transitioned to a full-time branch in Aylmer for its member community. Strong member growth since the branch opened on December 5 reflected a high degree of interest and appreciation within the community and in the surrounding area.

Realizing the need for growth, a partial service (one day a week) branch opened in Mount Forest on January 9, 2008; that same year, exceptions expanded, allowing individuals who shared our values to become members; a significant expansion for our credit union.

The following year, 2009, saw some great things, and some departures as the credit union grew in size and perspective. Some positive items of note were the beginning of a five-year streak of being awarded the Best Small and Medium Employers in Canada (by the Queens-Hewitt Best Small and Medium Employers staff engagement survey) and the successful transition of CEO from Nick Driedger to Brent Zorgdrager.

This was also the same year that MSCU launched Creation Care Loans – a new loan product developed in partnership with MCC Mennonite Initiative for Solar Energy. Going “green” was about enabling individuals and organizations to be “responsible stewards and care for God’s creation!”

In 2009 the Credit Committee was disbanded as the credit union and membership outgrew the Committee’s original purpose. The board was convinced that the oversight of lending on behalf of members was well managed instead by MSCU’s expert lending staff and the policies and internal controls developed over time to guide them.

Up until this point, when a new member opened an account with MSCU, one of the first questions asked to initiate conversation was “what Mennonite, Amish, or Brethren in Christ (now Be in Christ) church are you a member of?” Coming off membership expansions two years previously, the thought of inviting more to join the credit union – for all values-centred Ontarians – led to changes made to our bond in 2010, which provided an opportunity to review and refine the personal membership process. A new, streamlined process was introduced on May 2 that reflected a more open and welcoming approach.

Changes were in the air as our Mount Forest branch moved into full-time service and member shares were reduced from $250 to $25.

And perhaps one of the biggest changes – both in scale and MSCU history to date – was the $500,000 donation toward MCC Ontario’s new 50 Kent Avenue building – one that also houses our Kitchener branch! The groundbreaking for the building began in September 2012, and our Kitchener branch moved to 61 Kent during the renovations.

That same year, MSCU donated $1 million for the creation of the Mennonite Savings and Credit Union Centre for Peace Advancement at Conrad Grebel University College. Our ties to the Centre for Peace Advancement demonstrate our continued commitment to provide cooperative banking that connects values and faith with finances, inspiring peaceful, just, and prosperous communities.

By 2013, MSCU’s total assets were $900 million with over 19,000 members, and every branch – all eight of them – were offering full service. As an early living wage champion, MSCU signed on at the supporter level with the Living Wage Employers Recognition Program to become a Living Wage Employer in 2014, just in time for our 50th Anniversary!

As we entered the next decade of MSCU, change was no longer in the wind – it was right at our doorstep. MSCU was a recipient of the National Credit Union Social Responsibility Award in 2015, and July 2016 saw another impactful change: a rebrand and a rename!

Learn more about the transition of the credit union as we began Banking with Purpose in Part Three of Kindred Credit Union: A History of Making Peace with Your Money for 60 Years!